Liquidity conditions and monetary policy operations from 10 May to 1 August 2023. Excess liquidity in the euro area banking system declined significantly during the review period.

Liquidity conditions and monetary policy operations from 10 May to 1 August 2023

Prepared by Jens Budde and Petra Fricke

Published as part of the ECB Economic Bulletin, Issue 6/2023.

This box describes liquidity conditions and the Eurosystem’s monetary policy operations during the third and fourth reserve maintenance periods of 2023. Together, these two maintenance periods ran from 10 May to 1 August 2023 (the “review period”).

The Governing Council raised its three policy rates by 25 basis points at each of its meetings on 4 May 2023 and 15 June 2023. These increases took effect in the third and fourth reserve maintenance periods of 2023 respectively.

Excess liquidity in the euro area banking system declined significantly during the review period. This was due to the maturing of the fourth operation under the third series of targeted longer-term refinancing operations (TLTRO III) and banks’ early repayments of other TLTRO funds on 28 June 2023. Another contributing factor, albeit to a lesser extent, was the gradual reduction in the size of the asset purchase programme (APP) portfolio following the Eurosystem’s discontinuation of the reinvestments under the APP from 1 July. However, the continued decline in net autonomous factors, which added liquidity to the system, partly offset the reduction in excess liquidity. Net autonomous factors have been falling since the end of the negative interest rate environment in July 2022, owing mainly to the decrease in government deposits.

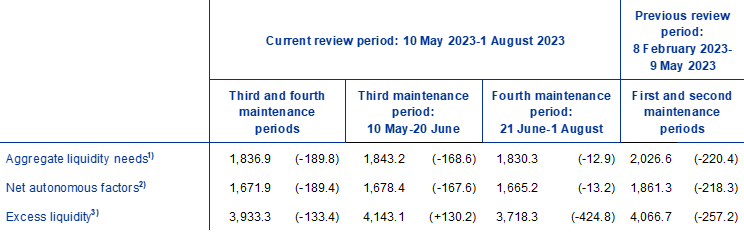

Liquidity needs

The average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, decreased by €189.8 billion to €1,836.9 billion in the review period. Compared with the first and second maintenance periods of 2023, this was due almost entirely to a €189.4 billion fall in net autonomous factors to €1,671.9 billion (see the section of Table A entitled “Other liquidity-based information”), driven by a decline in liquidity-absorbing autonomous factors and an increase in liquidity-providing autonomous factors. Minimum reserve requirements decreased only marginally by €0.3 billion to €165 billion.

Liquidity-absorbing autonomous factors decreased by €127.6 billion to €2,804.4 billion in the review period, owing mainly to a decline in government deposits and other autonomous factors. Government deposits (see the section of Table A entitled “Liabilities”) fell on average by €113.9 billion over the review period to €255.8 billion, with most of the decline taking place in the third maintenance period. This decline reflects the continued normalisation in the cash buffers held by national treasuries and an adjustment in their cash management strategies as a result of the lower ceiling for the remuneration of government deposits by the national central banks that took effect on 1 May 2023. The average value of banknotes in circulation increased by €8.2 billion over the review period to €1,565.3 billion.

Liquidity-providing autonomous factors rose by €62 billion, to stand at €1,133 billion. Net assets denominated in euro increased by €55.7 billion in the review period. This increase was largely the result of a continued fall in the liabilities to non-euro area residents denominated in euro in the third maintenance period. This in turn reflects an adjustment in the cash management strategies of customers of the Eurosystem reserve management services (ERMS), since the remuneration of deposits held under the ERMS framework was also adjusted as of 1 May 2023. Net foreign assets increased by €6.2 billion.

Table A provides an overview of the autonomous factors discussed above and their changes.[1]

Table A

Eurosystem liquidity conditions

Liabilities

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of the revaluation accounts, other claims and liabilities of euro area residents, capital and reserves.

2) Memo item that does not appear on the Eurosystem balance sheet and should therefore not be included in the calculation of total liabilities.

Assets

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period. “MROs” denotes main refinancing operations and “LTROs” denotes longer-term refinancing operations.

1) With the discontinuation of net asset purchases, the individual breakdown of outright portfolios is no longer shown.

Other liquidity-based information

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liabilities side and autonomous liquidity factors on the assets side. For the purposes of this table, items in the course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

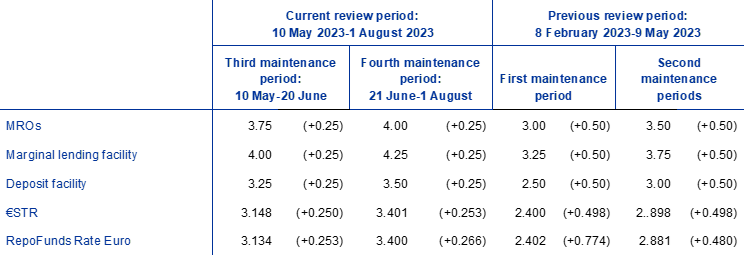

Interest rate developments

(averages; percentages and percentage points)

Sources: ECB, CME Group and Bloomberg.

Notes: Figures in brackets denote the change in percentage points from the previous review or maintenance period. The €STR is the euro short-term rate.

Liquidity provided through monetary policy instruments

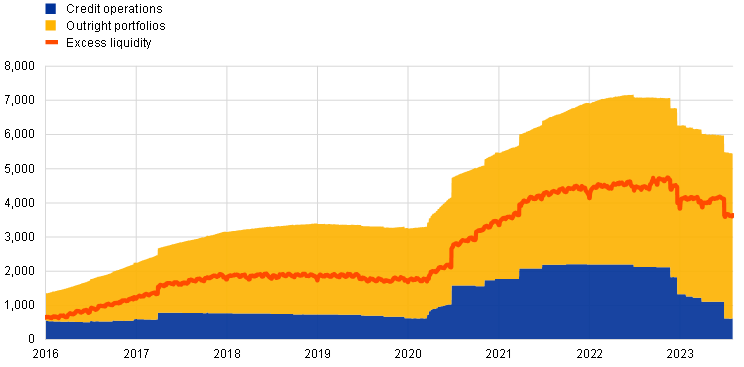

The average amount of liquidity provided through monetary policy instruments decreased by €326.6 billion to €5,766.7 billion during the review period (Chart A). The reduction in liquidity was driven primarily by a decline in credit operations.

The average amount of liquidity provided through credit operations fell by €274.7 billion during the review period. This decrease largely reflects the decline in outstanding TLTRO III amounts owing to the maturing of the fourth operation under TLTRO III (€476.8 billion) and banks’ early repayments of other TLTRO funds (€29.5 billion) on 28 June in the fourth maintenance period. At the same time, outstanding amounts under the standard Eurosystem refinancing operations (MROs and three-month LTROs) increased slightly in the fourth maintenance period.

The average amount of liquidity provided via holdings of outright portfolios decreased by €51.9 billion during the review period. Net asset purchases under the pandemic emergency purchase programme were discontinued at the end of March 2022, and since then the Eurosystem has been fully reinvesting the principal payments from maturing securities purchased under that programme. With regard to the APP, in line with the decision of the Governing Council, reinvestments of principal payments from maturing securities were reduced on average by €15 billion a month until the end of June and stopped completely as of 1 July.[2]

Chart A

Changes in liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

Note: The latest observations are for 1 August 2023.

Excess liquidity

Excess liquidity decreased by €467.8 billion from €4,114 billion on the last day of the previous review period, to stand at €3,646.1 billion on 1 August, the last day of the current review period. Average excess liquidity fell by €133.4 billion over the review period, to stand at €3,933.3 billion. Excess liquidity is the sum of banks’ reserves above the reserve requirements and the recourse to the deposit facility net of the recourse to the marginal lending facility. It reflects the difference between the total liquidity provided to the banking system and banks’ liquidity needs. After peaking at €4,748 billion in November 2022, excess liquidity has progressively decreased, mainly as a result of maturing operations and early repayments under TLTRO III, net of the effects of autonomous factors.

Interest rate developments

The euro short-term rate (€STR) increased by 51 basis points, from 2.894% on 9 May, the last day of the previous review period, to 3.404% on 1 August[3], the last day of the current review period, reflecting the ECB’s policy rate hikes. The pass-through of the policy rate increases in May and June 2023 to unsecured overnight money market rates was complete and immediate. On average, the €STR traded at 10.1 basis points below the deposit facility rate during the current review period, similarly to the first two maintenance periods of 2023.

The euro area repo rate, as measured by the RepoFunds Rate Euro index, increased by 55.7 basis points, from 2.881% on 9 May to 3.438% on 1 August (see footnote 3). The pass-through of the policy rate increases to the secured money market was also immediate and complete. The functioning of the repo market remained orderly owing to several factors, including higher net issuances since the beginning of the year and the release of mobilised collateral on the back of the maturing TLTROs, as well as a decline in the outstanding APP holdings.

-

For further details on autonomous factors, see the article entitled “The liquidity management of the ECB”, Monthly Bulletin, ECB, May 2002.

-

Securities held in the outright portfolios are carried at amortised cost and revalued at the end of each quarter, which also has an impact on the total averages and the changes in the outright portfolios.

-

The rate on 1 August was also influenced by end-of-month effects in July.

Poslední zprávy z rubriky Makroekonomika:

Přečtěte si také:

Prezentace

26.04.2024 Historie a vývoj vodovodních baterií: Od...

25.04.2024 Pobřeží Egejského moře - ideální tip na všechny...

24.04.2024 Výsledková sezóna: Jak se daří výrobcům čipů a...

Okénko investora

Olívia Lacenová, Wonderinterest Trading Ltd.

Dlouho očekávaná událost ze světa kryptoměn. Přinese další halving bitcoinu nová maxima?

Štěpán Křeček, BHS

Petr Lajsek, Purple Trading

Ali Daylami, BITmarkets

Michal Brothánek, AVANT IS

Miroslav Novák, AKCENTA

Spotřebitelská inflace v eurozóně odeznívá, pro služby to však úplně neplatí

Jiří Cimpel, Cimpel & Partneři

Jakub Petruška, Zlaťáky.cz