The fiscal impact of financial sector support measures 15 years after the great financial crisis. The impact of financial support measures enacted during the great financial crisis has declined considerably, but these still leave a mark on public finances

The fiscal impact of financial sector support measures 15 years after the great financial crisis

Prepared by Marien Ferdinandusse and Benoit Lichtenauer

Published as part of the ECB Economic Bulletin, Issue 6/2023.

During and after the global financial crisis, most euro area governments provided support to individual financial institutions to safeguard financial stability.[1] Interventions included measures such as injecting capital, nationalising banks, taking over impaired assets through public financial defeasance structures (also known as “bad banks”) and providing loans. This box looks at the direct impact of the assistance on euro area public finances, which is still visible 15 years later. The impact on public finances can be summarised as follows:

- Where these operations showed a clear loss for the government, they are classified as capital transfers that increase the budget deficit.

- Where the government received shares in a bank or debt securities considered of equal value to the capital injection provided, the support measure is considered a financial transaction that affects general government gross debt, but not the deficit.

- Where the government also issued guarantees to support the financial sector, these represent contingent liabilities that only affect public finances should they be called on.

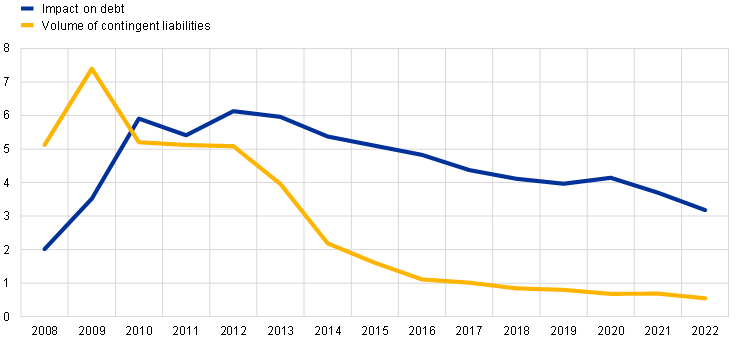

The impact of financial support measures enacted during the great financial crisis has declined considerably, but these still leave a mark on public finances today. For the euro area as a whole, financial support measures undertaken since 2007 increased public debt up to 2012, when the impact peaked at more than 6 percentage points of GDP (Chart A). Since then the debt impact has fallen, as governments have been able to sell the equity stakes they took in banks during the crisis and dispose of assets (mainly non-performing loans) held by bad banks. However, euro area government debt was still more than 3% of GDP higher in 2022 as a consequence of financial sector support, while outstanding guarantees amounted to around 0.5% of GDP (Chart A). The financing of financial sector support comprised debt securities (just over half), loans (17.7%) and other liabilities of general government entities (28.8%).[2] The latter category mainly consists of debt of (i) banks that were nationalised and reclassified under the general government sector and (ii) bad banks.

Chart A

Impact of financial sector support measures on euro area debt and the potential impact on debt from outstanding contingent liabilities, 2008-22

(percentages of GDP)

Source: Eurostat.

Notes: General government liabilities resulting from financial sector support measures affect observable debt. Contingent liabilities are obligations in the form of explicit guarantees which do not have any effect on the government accounts (aside from the revenues provided by guarantee fees) unless or until a particular event occurs in the future.

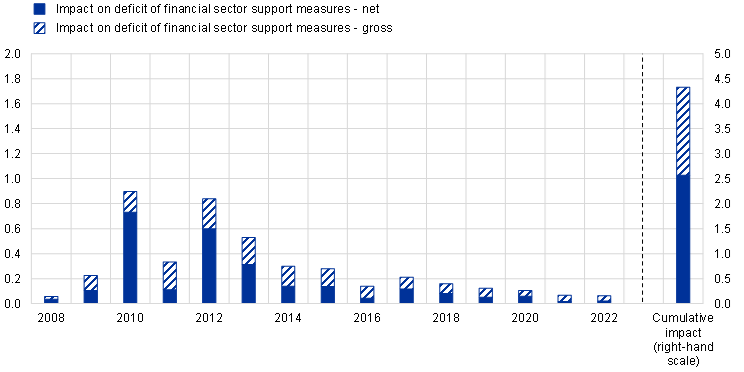

The support measures have increased the euro area government deficit every year since the financial crisis, although the impact has become very small in recent years (Chart B). In some of the earlier years, the deficit impact was dominated by capital transfers. In later years, expenditure related to the support, which is mainly interest payable and, to a lesser extent, capital transfers, has been larger than the associated revenues, which are mainly interest and dividends received.[3]

Chart B

Impact of financial sector support measures on the euro area deficit

(percentages of GDP)

Source: Eurostat.

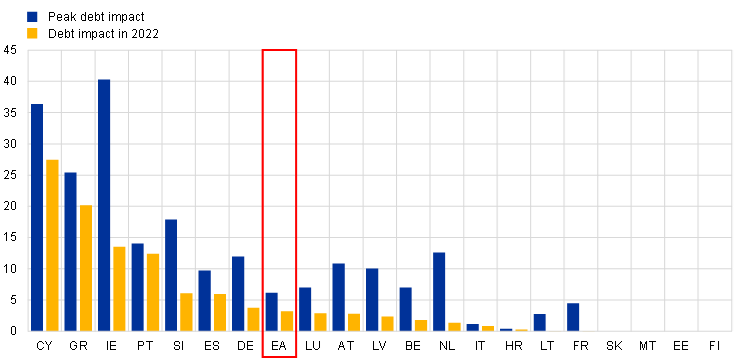

The fiscal impact of financial sector support measures differs considerably across euro area countries. A few countries took no action, or almost none, while the maximum impact on the debt/GDP ratio was close to 10% or more in ten euro area countries, including Germany, the Netherlands, Latvia, Austria, Slovenia, the four euro area countries that required an EU/International Monetary Fund (IMF) adjustment programme (Ireland, Greece, Cyprus and Portugal), and Spain[4], which requested financial assistance from the European Financial Stability Facility/European Stability Mechanism in 2012. The debt impact in the beneficiaries of EU/IMF adjustment programmes was still above 10 percentage points in 2022, in some cases well above (Chart C).[5]

Chart C

Impact of financial sector support measures on general government gross debt

(percentages of GDP)

Source: Eurostat.

Notes: The chart shows maximum general government liabilities expressed as a percentage GDP over the period 2007-2022 and in 2022. Countries are ranked by 2022 value.

The long-lasting direct impact of financial sector support measures on public finances shown in this box is only part of the overall economic costs of a financial crisis. These have also materialised in the form of lost output and higher unemployment. In addition, in some countries, adverse developments in the financial sector and government finances reinforced each other, pushing sovereign funding costs higher and exacerbating the financial and economic crisis. This caused an increase in the debt/GDP ratio that is not included in the estimates in this box. All of these factors illustrate the importance of having the necessary institutional framework in place to prevent episodes of macroeconomic and financial instability occurring and to mitigate their cost should they materialise. Since the great financial crisis, reforms have been undertaken in the EU to improve supervision of the financial sector, orderly resolution of failing financial institutions, sustainability of public finances and resilience of sovereign borrowers, for example by establishing the Single Supervisory Mechanism, the Single Resolution Mechanism and the European Fiscal Board.[6]

-

For a description of the financial crisis and fiscal and financial measures taken, see “Euro area fiscal policies and the crisis”, Occasional Paper Series, No 109, ECB, Frankfurt am Main, April 2010, and “Extraordinary measures in extraordinary times – public measures in support of the financial sector in the EU and the United States”, Occasional Paper Series, No 117, ECB, Frankfurt am Main, July 2010.

For more information on the statistical classification of support measures and their impact on public finances, see the article entitled “The fiscal impact of financial sector support during the crisis”, Economic Bulletin, Issue 6, ECB, 2015; “Financial assistance measures in the euro area from 2008 to 2013: statistical framework and fiscal impact”, Statistics Paper Series, No 7, ECB, Frankfurt am Main, April 2015; and the box entitled “The fiscal impact of financial sector support measures: where do we stand a decade on from the financial crisis?”, Economic Bulletin, Issue 6, ECB, 2018. The national accounts rules applicable to the statistical recording of support for financial institutions have been revised over time. As a consequence, the historical impact of the public interventions have sometimes changed significantly compared with these previous publications. Since Eurostat’s first decision on the statistical recording of public interventions to support financial institutions in 2009, the rules have been further revised until very recently (see the updated chapter 4.5 “Government intervention to support financial institutions: financial bailouts and defeasance structures” in the newly released 2022 edition of the Manual on Government Deficit and Debt). -

For more detail, see Eurostat’s background note of April 2023 on government interventions to support financial institutions.

-

In this respect, the fiscal impact of energy support measures in the euro area during the first two years of the energy crisis provides an insightful comparison. The cumulative net impact of the support to the financial sector between 2008 and 2022 on the euro area deficit was around 2.6% of 2022 GDP, while the net impact of energy support measures in the first two years of the energy crisis (2021-2022) was around 1.9% of GDP. See also the box entitled “Update on euro area fiscal policy responses to the energy crisis and high inflation”, Economic Bulletin, Issue 2, ECB, 2023.

-

In Spain, the impact of public support to the financial sector on government debt was significantly revised in 2021 (including the past data) when the asset management company Sociedad de Gestión de Activos procedentes de la Reestructuración Bancaria (SAREB) was reclassified under the government sector retrospectively since its creation in 2012. For more information, see the letter of 16 February 2021 from Eurostat to the Instituto Nacional de Estadística on the sector classification of SAREB.

-

For Ireland, the debt impact is better measured as a percentage of modified gross national income (GNI*), rather than GDP, on account of the impact of tax operations of multinational companies on GDP. The debt impact of the financial sector support peaked at 53% of GNI* in 2013 and was 25% in 2022.

-

See the following links for more information on the Single Supervisory Mechanism, the Single Resolution Mechanism and the European Fiscal Board.

Poslední zprávy z rubriky Makroekonomika:

Přečtěte si také:

Prezentace

26.04.2024 Historie a vývoj vodovodních baterií: Od...

25.04.2024 Pobřeží Egejského moře - ideální tip na všechny...

24.04.2024 Výsledková sezóna: Jak se daří výrobcům čipů a...

Okénko investora

Olívia Lacenová, Wonderinterest Trading Ltd.

Dlouho očekávaná událost ze světa kryptoměn. Přinese další halving bitcoinu nová maxima?

Štěpán Křeček, BHS

Petr Lajsek, Purple Trading

Ali Daylami, BITmarkets

Michal Brothánek, AVANT IS

Miroslav Novák, AKCENTA

Spotřebitelská inflace v eurozóně odeznívá, pro služby to však úplně neplatí

Jiří Cimpel, Cimpel & Partneři

Jakub Petruška, Zlaťáky.cz