Deset let od eskalace dluhové krize eurozóny - čnBlog

V září a v říjnu 2011 začala dluhová krize eurozóny nabírat rychlé obrátky. Krize započala již na podzim 2009. V té době se týkala téměř výhradně hospodářské a fiskální situace v Řecku. V průběhu roku 2011 se však začaly obavy ohledně udržitelnosti veřejného dluhu šířit napříč dalšími zeměmi eurozóny (Irsko, Portugalsko, Španělsko, Kypr, ale i Itálie a Belgie). Výprodej státních dluhopisů ze strany investorů, ať již z důvodu těchto obav nebo neochoty setrvávat na příliš volatilním trhu, vedl k prudkému nárůstu jejich požadovaných výnosů. To dále zhoršilo fiskální vyhlídky těchto zemí, neboť se výrazně zdražilo financování nejen jejich veřejnému, ale i soukromému sektoru. Zdlouhavé vyjednávání politických špiček eurozóny při hledání kompromisních řešení nastalé situace a místy i jejich neochota se dohodnout na razantní a pro finanční trhy důvěryhodné reakci nakonec vedla k rozsáhlé dluhové krizi, která ohrožovala samotnou existenci eurozóny. Jelikož se tyto události již staly svým způsobem dávnou historií, je vhodné si připomenout některé podstatné skutečnosti.

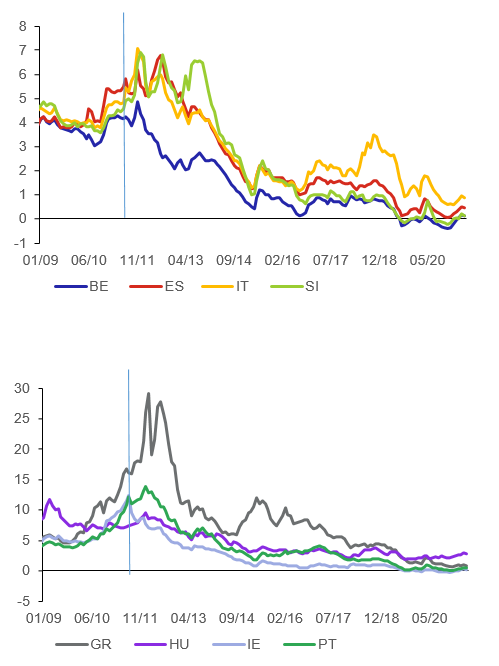

Graf 1 – Vývoj výnosů státních dluhopisů vybraných zemí eurozóny (výnosy 10letých státních dluhopisů v %)

Zdroj: IMF

Výše uvedené země se po propuknutí dluhové krize v Řecku dostaly ve velmi krátkém období do značně ztížené situace ohledně financování svých veřejných dluhů. Na trzích státních dluhopisů zemí eurozóny byl patrný rozchod ve výnosech (decoupling) způsobený „útěkem investorů k jistotě“ (Graf 1). Rychlý nárůst výnosů pak dopadal zejména na země, které v dané době refinancovaly značné objemy svých vysokých dluhů, ale i země financující nové dluhy vzniklé podporou svých bankovních sektorů. Explicitní či implicitní státní záruky či jiné podpory nezbytné pro zachování stability bankovních sektorů zasažených globální finanční krizí zvyšovaly veřejné zadlužení a dále zhoršovaly vnímání o udržitelnosti veřejného dluhu. Některé banky nebyly schopny poskytovat v plném rozsahu své služby reálné ekonomice, což se nepříznivě promítalo do hospodářského výstupu a zpětně do veřejných financí. Jako členové měnové unie neměly postižené ekonomiky k dispozici oslabení či devalvaci měny, a potřebné přizpůsobení tak muselo probíhat přes složitější a pomalejší interní devalvaci.

Přes nepopiratelné ekonomické faktory byla krize eurozóny primárně krizí politickou, což odráží skutečnost, že „euro“ je primárně politický projekt. Politické špičky eurozóny dlouho vnímaly celou situaci jako izolovaný fiskální problém Řecka a věnovaly neadekvátně velké úsilí tomu, aby se jeho vláda výměnou za pomoc zavázala k fiskální konsolidaci a strukturálním reformám. Podmínky a mechanismy dočasného záchranného fondu EFSF (European Financial Stability Facility) dohodnutého hlavami států eurozóny v květnu 2010 i proto nebyly příliš flexibilní. Vedle Řecka využily tuto finanční asistenci rovněž Irsko a Portugalsko. Zřízení fondu v červnu 2010 situaci každopádně na několik měsíců uklidnilo. To se ale nakonec ukázalo být kontraproduktivním, neboť politické reprezentace i tržní účastníci podlehli částečně iluzi, že problémy vládní dluhové krize eurozóny jsou tím vlastně vyřešeny.

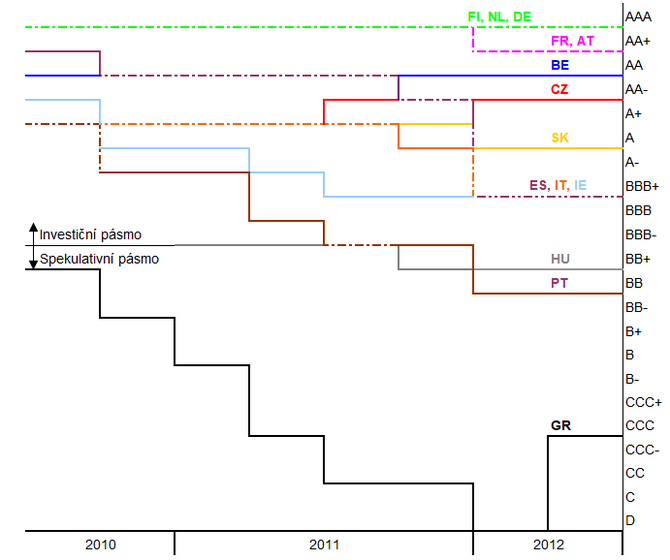

Graf 2 – Vývoj svrchovaných ratingů vybraných zemí (dlouhodobý rating v zahraniční měně)

Zdroj: Standard & Poor´s

Vzhledem k omezené časové působnosti EFSF a původní omezené efektivní kapacitě, kdy se do potíží se splácením dostávaly další země, začalo být zřejmé, že tomu tak není. Následovala série jednání hlav států a summitů. Za jedno z rozhodujících opatření byla nejprve považována dohoda o zřízení eurovalu ESM (European Stability Mechanism), tj. stálého záchranného fondu eurozóny. Plán na jeho vytvoření byl odsouhlasen na přelomu let 2010 a 2011 s tím, že začne plně fungovat od roku 2013, ale s dohodnutými prostředky bude disponovat v plném rozsahu až později. Základní problém spočíval v tom, že i kvůli politickým rozepřím v „zachraňovaných“ i „zachraňujících“ zemích a neuspořádané veřejné výměně názorů mezi představiteli jednotlivých zemí začali mít mezinárodní investoři stále větší pochybnosti o tom, zda budou stabilizované ekonomiky eurozóny skutečně ochotny těm ohroženým poskytnout dostatek prostředků. Situace proto začala poměrně rychle eskalovat. Ratingové agentury opakovaně přistoupily ke zhoršení úvěrového hodnocení u celé skupiny členských zemí eurozóny, u některých dokonce pod investiční stupeň (Graf 2). Výnosy z dluhů těchto zemí se tak opakovaně dostávaly na úrovně, při kterých byly pochybnosti o jejich solventnosti oprávněné (Graf 1).

Na zjitřenou situaci se snažil reagovat další z klíčových summitů, který se uskutečnil v říjnu 2011 v Bruselu. Účastníci se dohodli na potřebě navýšit „palebnou sílu“ záchranných mechanismů a na možné využití jejich prostředků pro stabilizaci bankovních sektorů. Zároveň značná část zemí trvala na tom, že cestou k dlouhodobému obnovení důvěry a stability eura je fiskální konsolidace. Vyvrcholením se pak měla stát mezivládní smlouva „European Fiscal Compact“ představující striktnější verzi Paktu stability a růstu. Ta byla po několikatýdenním jednání schválena na konci ledna 2012 na summitu v Bruselu zástupci všech zemí eurozóny. Politické špičky v dobré, leč naivní, víře deklarovaly, že smlouva je klíčovým krokem nejen v obnovení důvěry v eurozónu, ale i k nastartování ekonomického růstu.

Tyto naděje se však nenaplnily – nejen v roce 2012, ale koneckonců ani nikdy potom. Dluhová krize eurozóny pokračovala až do července 2012, kdy prezident ECB Mario Draghi připustil, že ECB je připravena udělat cokoli, aby euro zachránila. Tato slova byla pochopena tak, že ECB přebírá zodpovědnost za udržitelnost veřejných financí v zemích eurozóny, a pokud to nebude v rozporu s cílem cenové stability, bude připravena nakupovat rozsáhlé objemy státních dluhopisů, aby i ve vysoce zadlužených zemích náklady na financování nejen veřejných dluhů zůstávaly dostatečně nízké. Dluhová krize pak ztratila dynamiku. Mario Draghi je dnes vnímán jako zachránce eura. Jeho krok, tj. obrat v politice ECB v létě 2012, lze ale považovat za reflexi seznání, že politické špičky eurozóny nejsou schopny dosáhnout účinného řešení dluhové krize. Jedinou institucí, která to byla schopna zajistit, tak byla ECB. Závazek ECB se ukázal být kredibilním a nákupy státních dluhopisů ze strany eurosystému proto nemusely být zpočátku rozsáhlé. Ke konci roku 2012 držel eurosystém podle výročních zpráv ECB pro měnové účely státní dluhopisy v objemu 209 mld. EUR, ke konci 2013 pak jen 179 mld. EUR.

Graf 3 – Cenné papíry držené eurosystémem (v mld. EUR)

Zdroj: ECB

Pozn.: Data jsou získána ze tří odlišných statistik, Eurosystém – ECB a národní centrální banky eurozóny, APP – Asset Purchase Program

V polovině roku 2014 však bylo v reakci na přetrvávající nepříznivý ekonomický vývoj a rizika příliš dlouhého období nízké inflace rozhodnuto o nastartování programu nákupu aktiv, přičemž o státní dluhopisy byl program rozšířen v lednu 2015. V rámci tohoto programu nyní drží eurosystém v bilanci aktiva za více než 3 biliony EUR, přičemž 80 % z toho představují státní dluhopisy (Graf 3). Politici i tvůrci hospodářské politiky se z krize nepochybně poučili. Díky tomu byli po propuknutí pandemie v roce 2020 schopni aktivovat a koordinovat rozsáhlé stabilizační programy, které zabránily výraznějším otřesům. Ke konci koronavirové krize je však stále více viditelné, že stabilita veřejného a koneckonců i soukromého sektoru v eurozóně je ještě více než dříve závislá na rozsáhlých nákupech aktiv centrální bankou. Zároveň se v eurozóně změnila ideologie ohledně vztahu veřejných financí a hospodářského růstu. Zatímco před 10 lety převládal konsenzus, že k vyššímu hospodářskému růstu je nezbytné se prospořit, nyní začíná dominovat názor, že je naopak nutné se proutrácet.

Klíčovou nedořešenou a v podstatě neřešenou otázkou zůstává, jak z dlouhodobého hlediska eurozónu stabilizovat fiskálně. Pandemie COVID-19 složitost této otázky dále prohloubila a diskusi o ní zřejmě na delší dobu odložila. ECB, resp. eurosystém, svou aktivní politikou kolaterálu již ukázala, že může v mnoha ohledech fungovat jako efektivní věřitel či trh poslední instance a v případě potřeby ovlivnit tržní likviditu a tím ceny řady aktiv. Programy nákupu státních dluhopisů vedly k poklesu rizikových prémií i u vysoce zadlužených zemí, i když z dlouhodobého hlediska jejich kreditní riziko „nezmizelo“. Zásadní rozdíly v rizikovosti státních dluhopisů jednotlivých zemí eurozóny do značné míry blokují projekty či regulatorní návrhy, které mohou mít dlouhodobě stabilizující efekty.

Mezi takové patří projekty ohledně zvýšení objemu bezpečných aktiv v Evropě a diverzifikace portfolia státních dluhopisů v bankovním sektoru, a to pomocí vzniku evropských bezpečných či podřízených dluhopisů (tzv. ESBies a EJBies), resp. cenných papírů krytých státními dluhopisy vydanými zeměmi eurozóny (tzv. SBBS). V roce 2016 zřídila Evropská rada pro systémová rizika pracovní skupinu na vysoké úrovni s mandátem zkoumat praktické aspekty do té doby spíše akademické úvahy o sekuritizaci těchto státních dluhopisů. Přes řadu negativních názorů od některých členských zemí či industrie ohledně smysluplnosti vzniku těchto finančních aktiv, prostřednictvím nichž by se prakticky sekuritizovala obchodovatelná a likvidní aktiva, předložila Evropská komise v květnu 2018 legislativní návrh umožňující rozvoj trhu SBBS. Ten Evropský parlament v dubnu 2019 v prvním čtení schválil, avšak Rada EU pozici k návrhu stále nepřijala.

Vedle toho se v souvislosti s negativními efekty úzké vazby mezi bankovním a veřejným sektorem stále diskutuje změna preferenčního regulatorního zacházení se svrchovanými expozicemi bank (ESRB), a to i v souvislosti s dokončením bankovní unie jakožto klíčovým prvkem měnové unie. Některé země eurozóny vidí v revizi bankovní regulace kreditního rizika a rizika koncentrace možnost, jak dosáhnout diverzity v držení státních dluhopisů bank. Jiné takový návrh odmítají s tím, že by došlo k výraznému narušení fungování trhů se státními dluhopisy. Země eurozóny tak v oblasti regulace expozic vůči vládám stejně jako na mezinárodní úrovni (BCBS) prozatím nedosáhly žádného politického závěru. A to se hned tak nezmění.

The fiscal impact of financial sector support during the crisis

During the financial crisis, most euro area governments provided financial assistance to ailing financial institutions with the aim of safeguarding financial stability and preventing a credit crunch. Over the period 2008-14 accumulated gross financial sector assistance amounted to 8% of euro area GDP, of which 3.3% has been recovered. The fiscal costs of the assistance to financial institutions are comparable to those of other systemic banking crises in the past, as they led to a deterioration in the euro area budget balance and debt by a cumulated 1.8% and 4.8% of GDP respectively. However, on average the measures account for a relatively small part of the overall strong increase in general government debt since the outbreak of the crisis. At the same time, outstanding government guarantees (amounting to 2.7% of euro area GDP at the end of 2014) and further potential losses of asset management vehicles to which impaired assets had been transferred still pose additional fiscal risks to governments. Looking ahead, it is important both to reduce the likelihood of financial institutions facing severe balance sheet problems by enhancing bank capital, banking regulation and supervision, and to promote bank resolution policies that include private sector involvement, thereby protecting taxpayers. In this sense, the recent steps towards a genuine European banking union are encouraging and should not only help to prevent and/or resolve future banking crises in the euro area, but also to reduce their potential fiscal impact on government deficits and debt.

1 Introduction

Since the outbreak of the financial crisis, most euro area governments have provided substantial financial assistance to financial institutions with the aim of safeguarding financial stability and preventing a credit crunch. These measures contributed to the increase in euro area general government debt, which rose by 27 percentage points between 2008 and the end of 2014, when it stood at 92% of GDP. The direct net fiscal costs of financial sector assistance (less than 5% of GDP) were only one factor explaining the overall sharp rise in government debt in the euro area. Yet they played a much more important role in a number of euro area countries. A preliminary assessment of the fiscal impact of financial sector support was provided at an early stage of the financial crisis.[1] Given that further support has been provided since then and in view of the gradual recovery of the euro area financial sector and the recent reforms supporting the prevention of banking crises, it is now a good time to reassess the fiscal costs of financial sector support.

This article addresses the following questions: First, which financial assistance measures have been used? Second, how costly were the financial sector assistance measures for taxpayers, how much of the costs have been recovered to date and how much have the measures contributed to the sharp increase in government debt? Third, what are the remaining fiscal risks related to financial sector support? In addressing these questions, the article provides a detailed overview of the government measures to assist financial institutions since the beginning of the crisis.[2] Compared with other systemic banking crises in advanced economies, the direct fiscal costs of financial assistance measures in the euro area are of a similar magnitude, while the overall increase in general government debt is considerably larger. However, the estimated fiscal costs of government intervention in the banking sector vary substantially across studies depending on the methodology used for their derivation and the definition of fiscal costs. This article mainly follows the bottom-up approach which sums up all of the government measures related to the financial crisis, although some of these measures may be difficult to quantify, especially if they were carried out by entities classified outside the general government sector.[3] The article focuses on government measures to support the financial sector and does not look at the central bank liquidity measures adopted during the financial crisis.[4]

The article is structured as follows: Section 2 looks at the support measures used by euro area governments over the period 2008-14, with a particular focus on asset acquisitions and capital transfers. Section 3 assesses their fiscal impact on budget balances and general government debt and discusses the recovery rates on acquired assets. Section 4 outlines the remaining fiscal risks related to government guarantees and asset management vehicles. The article ends with some policy conclusions in Section 5.

2 Financial sector assistance measures

Most euro area governments have supported the financial sector with a set of measures, notwithstanding considerable differences across countries and changes over time. For example, governments supported financial institutions by purchasing their illiquid financial assets and by providing them with direct loans. The acquired assets included equities, debt securities and other assets, which governments exchanged against cash or other collateral at their market value. Sometimes governments had to inject capital into ailing financial institutions by acquiring assets well above their market value. These recapitalisations aimed to cover the banks’ accumulated losses and eventually resulted in government losses. Some governments were also forced to nationalise (systemic) banks. Moreover, some of the impaired assets were acquired by newly created asset management vehicles. In exchange for the transferred assets, financial institutions were provided with cash and/or bonds issued by the vehicles usually enjoying a state guarantee. Governments also provided explicit guarantees to financial institutions, such as time-restricted guarantees for interbank loans or bonds, and raised the coverage threshold for guaranteed bank deposits. Furthermore, the higher government debt resulting from most of these interventions led to indirect fiscal costs in the form of additional interest payments. At the same time, government interventions also implied indirect revenues in the form of fees for guarantees granted, dividends on acquired equity and interest receipts on the loans provided and debt securities bought.

Chart 1

Assets acquired over the period 2008-14

![]() net acquired assets sales/repayments

of aquired assets

net acquired assets sales/repayments

of aquired assets

6

5

4

3

2

1

0

Acquired financial Equity Provision of Debt securities assets (total) instruments new loans and other assets

Source: ESCB.

Note: The sum of the net acquired assets (blue) and the sales/repayments (yellow) corresponds to the gross amount of the respective acquired assets.

Among the measures mentioned above, the acquisition of financial assets was used by euro area governments in particular in the early years of the financial crisis. Between 2008 and 2014 governments acquired financial assets in an amount of 5.3% of euro area GDP in gross terms (see Chart 1), two-thirds of which were purchased in the first three years of the crisis. When taking into account the fact that part of the assets has in the meantime been divested without losses, the net acquired assets amounted to 2.9% of GDP in 2014. Among the acquired assets, debt securities and equities together accounted for the bulk (around 90%) of the acquired assets, while new loans were used to a much lower degree over the period 2008-14. The net acquisition of financial assets was particularly pronounced in Germany, Ireland, Greece, Cyprus, Luxembourg, Portugal and

Slovenia, with acquisitions being well above 5% of GDP (see column (A) of Table 2).

Moreover, euro area governments supported distressed financial institutions via capital transfers. Besides financial assets purchased at above-market prices, capital transfers reflected called government guarantees and other types of debt assumption. Capital transfers amounted to 2.1% of GDP over the period 2008-14. These deficit-increasing capital transfers played a role in particular in Ireland (above 25% of GDP), Greece, Cyprus and Slovenia, while in other countries their extent was more limited (see column (C) of Table 2).

3 Fiscal impact of financial assistance measures

General government debt in the euro area increased from 65% of GDP in early 2008 to 92% of GDP at the end of 2014. Only a relatively small part of this rise in government debt, which was particularly pronounced in the first years of the financial crisis, was driven by the support provided by euro area governments to ailing financial institutions in order to secure financial stability, although for some

Chart 2

Change in government gross debt and its drivers

Notes: Defi cit-debt adjustment is the difference between the government defi cit and the change in government debt. For more details, see “From government defi cit to debt: bridging the gap”, Monthly Bulletin, ECB, April 2007.

individual countries the impact on government debt was substantial. To better understand how government finances were affected by the financial crisis in general and by financial sector support interventions in particular, it is useful to decompose the government debt increase into its main driving factors (see Chart 2).

First, the debt-increasing impact of a positive interest rate-growth differential, which captures the difference between the interest rate paid to service government debt and the growth rate of the economy, was particularly strong in the early years of the crisis, following the cyclical downturn in the euro area triggered by the financial crisis. More recently, as a consequence of low interest rates and a cyclical recovery, its relative importance has started to decline.

Second, the rise in government debt was also driven by a sharp deterioration of the primary balance. This was inter alia the result of higher primary expenditure, reflecting the role of automatic stabilisers, such as higher unemployment benefits, as well as discretionary fiscal policy measures. The latter also

include part of the financial sector assistance measures, in particular the costs of capital transfers to cover accumulated losses of ailing banks. Moreover, lower government revenues following the cyclical downturn and the rebalancing process also contributed to the worsening of the primary balance via so-called second-round effects, as the decline in employment, corporate profits and asset values, triggered by the financial crisis, resulted in lower revenues.

Third, the debt increase was driven by deficit-debt adjustments. These had several causes. Among them are those financial sector support measures that did not affect the primary balance, but did affect general government debt, such as governments’ acquisition of equities at market prices or the provision of government loans to the financial sector. As the governments acquired assets, these measures resulted in an increase in gross debt, while net debt remained largely unaffected. Deficit-debt adjustments were particularly pronounced until 2010 for the euro area as a whole.

To quantify the impact of the financial sector assistance measures on the government accounts, it is necessary to look at the individual transactions and the financing requirements resulting from them. Depending on the nature and the magnitude of the assistance measures, government finances are affected differently (see Table 1).

Table 1

Accounting framework for general government assistance to the financial sector

Impact on general Impact on fiscal

Examples government debt balance

|

Direct impact of interventions |

|||

|

Acquisition of fi nancial assets |

Acquisition of equities (market price) |

^ |

0 |

|

Acquisition of other assets, e.g. debt securities |

^ |

0 |

|

|

Provision of loans |

^ |

0 |

|

|

Sales of shares |

ˇ |

0 |

|

|

Repayments of loans |

ˇ |

0 |

|

|

Capital transfers to banks |

Acquisition of fi nancial assets above market price |

^ |

^ |

|

Capital injections covering bank losses |

^ |

^ |

|

|

Debt assumptions |

^ |

^ |

|

|

Called government guarantees |

^ |

^ |

|

|

Indirect impact of interventions |

|||

|

Miscellaneous revenues and expenditures |

Guarantee fees Dividends |

ˇ ˇ |

ˇ ˇ |

|

Interest payable/ receivable |

^ˇ |

^ˇ |

|

|

Reclassifi cation of entities and other fl ows (without transactions) |

|||

|

Entities reclassifi ed from fi nancial Liabilities of entities (i.e. the non-consolidated sector to general government liabilities) |

^ |

0 |

|

|

Assets of entities (i.e. only the consolidated assets) |

(ˇ) |

0 |

|

|

Provision of guarantees |

|||

|

Government guarantees Guarantees on liabilities (contingent liabilities) |

0 |

0 |

|

|

Guarantees on assets |

0 |

0 |

|

Source: ESCB.

• While all instruments, except for outstanding government guarantees, increase government debt, most of them do not affect the budget balance (see Table 1). In particular, net acquisitions of financial assets by governments, including equities, loans and debt securities at market prices, are debt-increasing.

• Acquisitions of financial assets usually only affect gross government debt, while net government debt remains broadly unchanged.

• By contrast, all financial sector support measures that include an irreversible annual expenditure for the government are recorded in the cumulated budget balance (see Table 1 and column (B) of Table 2). They include capital transfers, such as the debt of banks taken over by the government, called government guarantees, financial assets purchased at above-market prices and deficit-increasing capital injections into banks to cover past losses. In addition, the general government budget balance is also affected by revenues that are linked to financial support transactions, such as fees received by governments for granting guarantees, dividends from acquired equities as well as interest received on financial instruments acquired. The sum of the net acquisition of financial assets and the cumulated impact on the budget balance represents the government’s net fiscal costs of the financial assistance measure (see Table 2).

• The reclassification of entities from the financial sector to the general government sector (notably in the case of bank nationalisations) increases government debt.

• The provision of government guarantees has no direct impact on public finances, unless the guarantees are called.

Financial assistance measures led to a worsening of the euro area budget balance by a cumulated 1.8% of GDP between 2008 and 2014. How their impact on government accounts is treated in the Stability and Growth Pact is described in the box later in this article. The impact on the budget balance differed considerably across countries. The deficit impact was particularly strong in Ireland, where it led to a cumulated worsening of the budget balance of almost 25% of GDP (see Table 2). The budget balances of Greece, Cyprus and Slovenia were also substantially affected by the support measures, with a cumulated deficit impact of between 8% and 13% of GDP during 2008-14. In most other countries, the cumulated deficit impact was more limited, ranging from 0.4% of GDP in Belgium to 4.4% of GDP in Spain. For France, Italy and Luxembourg, the cumulated revenues from financial assistance measures even slightly exceeded the expenditures.

Table 2

Fiscal impact of financial sector support over the period 2008-14

![]()

(percentages of 2014 GDP)

|

Net fiscal costs |

EDP debt impact |

Memo item: Change in government debt |

||||||||||

|

Total (A)+(B) |

Net acquisitions of financial assets (A) |

Cumulated impact on budget balance (deficit (+), surplus (-)) |

(end of 2014) (D) |

(2008-14) |

||||||||

|

(B) |

due to capital transfers (C) |

|||||||||||

|

BE |

3.7 |

3.3 |

0.4 |

1.1 |

4.6 |

19.7 |

||||||

|

DE |

8.0 |

6.7 |

1.3 |

1.8 |

8.2 |

11.0 |

||||||

|

IE |

31.1 |

7.0 |

24.1 |

25.7 |

22.6 |

85.7 |

||||||

|

GR |

22.1 |

9.6 |

12.5 |

14.9 |

22.2 |

73.7 |

||||||

|

ES |

5.0 |

0.6 |

4.4 |

4.8 |

5.0 |

62.2 |

||||||

|

FR |

0.0 |

0.1 |

-0.1 |

0.1 |

0.1 |

31.1 |

||||||

|

IT |

-0.1 |

0.0 |

-0.1 |

0.0 |

0.1 |

32.4 |

||||||

|

CY |

18.8 |

10.3 |

8.5 |

9.1 |

19.4 |

53.4 |

||||||

|

LV |

5.2 |

1.9 |

3.3 |

3.3 |

5.5 |

31.6 |

||||||

|

LT |

1.3 |

0.2 |

1.1 |

0.9 |

0.9 |

25.0 |

||||||

|

LU |

5.5 |

5.6 |

-0.1 |

0.1 |

5.3 |

16.0 |

||||||

|

NL |

4.8 |

4.1 |

0.7 |

0.7 |

5.5 |

26.1 |

||||||

|

3.5 |

0.4 |

3.1 |

3.6 |

8.4 |

19.7 |

|||||||

|

PT |

11.3 |

8.4 |

2.9 |

2.6 |

11.0 |

61.7 |

||||||

|

Sl |

18.1 |

6.1 |

12.0 |

11.5 |

18.2 |

58.2 |

||||||

|

EA |

4.7 |

2.9 |

1.8 |

2.1 |

4.8 |

27.0 |

||||||

Sources: ESCB and Eurostat.

Notes: Estonia, Malta, Slovakia and Finland are not included in the table as no fi nancial support was provided to the fi nancial sector. The difference between the cumulated budget balance (B) and capital transfers (C) includes net miscellaneous fi nancing costs or revenues, such as fees on guarantees, dividends, and interest payable or receivable linked to acquired fi nancial instruments. As regards column (D), in comparison to the net fi scal costs, the excessive defi cit procedure (EDP) debt impact also includes the impact of reclassifi cations of fi nancial entities (e.g. a bad bank) inside the government (without transactions), other fl ows and fi nancial transactions not recorded in EDP debt.

General government debt in the euro area increased by 4.8% of GDP over the period from 2008 to 2014 owing to financial sector assistance. The impact on government debt resulted from the sum of the net fiscal costs of financial sector support (4.7% of GDP) and the impact of reclassifications and other flows (0.1% of GDP).[5] The debt increase as a result of financial sector support corresponds to less than one-fifth of the increase in government debt over the same period (see Table 2).

The debt impact of financial sector support varied considerably across countries.

Financial sector support led to a substantial increase in government debt of around 20% of GDP in Ireland, Greece, Cyprus and Slovenia. It also had a high impact in Germany, especially owing to measures taken at the onset of the crisis, and in Austria and Portugal, mainly as a result of more recent interventions. By contrast, government debt in Italy and France was hardly affected by financial sector support.

Compared with past financial crises in advanced economies, the deterioration in euro area government finances was worse, despite a similar amount of financial sector assistance. According to a recent study from the International Monetary Fund (IMF), which measured the fiscal costs of 60 systemic banking crises between 1970 and 2011, the median increase in overall government debt was around 12% of GDP, of which 7 percentage points were accounted for by the direct fiscal costs of financial sector support.[6] Regarding the recent crisis (2007-11), the IMF analysis looks at a sample of 25 systemic banking crises, mainly involving advanced economies. The median increase in government debt was 18% of GDP, of which 4.2 percentage points were due to direct fiscal costs, compared with an increase in government debt for the euro area of almost 22% of GDP, of which only 4.6 percentage points were explained by direct financial sector support. These differences suggest that the indirect macroeconomic costs of the financial crisis in the euro area have been even more pronounced compared with previous systemic banking crises.

The recovery rates, which represent the share of acquired assets which governments were able to successfully dispose of, are improving, but are still relatively low by historical standards. Recovery rates are derived from the difference between the acquired financial assets in gross terms and the assets in net terms. Up to now, eight years after the crisis started, only a small fraction of the fiscal costs of the euro area has been recovered (see Chart 3). Out of 8% of GDP of accumulated gross financial sector assistance measures,[7] which corresponds to €800 billion, 3.3% of GDP has been recovered through sales of acquired assets and other miscellaneous revenues derived from the assets acquired and the guarantees granted (e.g. dividends, fees, interest receipts). This corresponds to a recovery rate Chart 3

Fiscal costs and recovery rates over the period 2008-14

Sources: ESCB and Eurostat.

Notes: Estonia, Malta, Slovakia and Finland are not included in the chart as no fi nancial sector support was provided in these countries. As regards Greece, see also footnote 9. The recovery rate is the difference between the acquired fi nancial assets in gross and net terms.

of slightly more than 40% of gross fiscal costs, which is relatively low by international comparison. For example, Sweden was able to recover almost 95% of its budgetary outlays five years after the crisis in 1991.[8] The recovery rates to date are particularly low in Ireland, Cyprus and Portugal, while they are relatively high in the Netherlands.[9]

The recovery rates, however, differ for different types of acquired assets. Looking at the different instruments, most (92%) of the loans provided to banks had been paid back by the end of 2014 (see Chart 1). By contrast, governments still hold a large share of the acquired debt securities and equities, although they were able to sell 43% of the debt securities and 34% of the equities by end-2014. Consequently, the accumulated net acquisition of both debt securities and equities amounted to

1.4% of GDP by the end of 2014.

At the same time, the recovery rates also need to be carefully analysed, together with the accumulated losses related to the assistance measures. In fact, a low recovery rate might be due to very different scenarios and does not necessarily indicate high accumulated losses. For example, a limited recovery rate could indicate, in the best case, that a government retains ownership of a well-performing bank which would generate substantial gains in the event of a subsequent privatisation. In the worst case, a limited recovery rate could indicate that the interventions led to major irreversible losses, as in the case of Cyprus, with a holding loss for the government on equity instruments amounting to 10.5% of GDP owing to the restructuring of one of its largest banks. For the period 2008-14 the accumulated losses on average for the euro area amounted to 1.8% of GDP, thus indicating that almost 25% of the gross fiscal needs are currently accounted for as a loss which cannot be recovered.

Box

Treatment of financial sector support in the Stability and Growth Pact

![]()

In the Stability and Growth Pact (SGP), financial sector support is treated in a special manner given its importance for safeguarding financial stability. At times of severe banking problems, Member States are generally not required to compensate for the fiscal costs arising from financial sector support, provided the measures are of a temporary nature.[10] Given that the fiscal costs to secure financial stability are largely beyond the control of governments, this seems broadly justified. In fact, it is important that the SGP does not provide disincentives to effective public backstops. A similar approach has also been taken in the EU-IMF adjustment programmes, in which nominal fiscal targets are set explicitly by excluding the impact of financial sector support on the deficit.

Under the preventive arm of the SGP, capital injections are excluded from the calculation of the structural effort, provided they are temporary. The structural effort is the main indicator under the preventive arm to assess whether the adjustment path towards the medium-term objective (MTO) is fulfilled. The structural effort is calculated based on the change in the structural balance, which excludes temporary and one-off measures such as capital injections.

Under the corrective arm of the SGP, an excessive deficit procedure (EDP) may not be opened in the case of financial sector support. If a Member State were to be temporarily in breach of the deficit criterion as a result of financial sector support, but the deficit would remain close to 3% of GDP (i.e. not more than 0.5% of GDP above the reference rate), opening an EDP can be avoided. Likewise for the debt, when non-compliance with the debt reduction benchmark results from financial sector support, a debt-based EDP will not be opened. In both cases, financial sector support measures (including contingent liabilities) are accounted for as relevant factors, as under the debt-based EDP assessments for Belgium and Italy published in February 2015.

In addition, financial sector support would not lead to the stepping-up of an existing EDP. Compliance with the EDP requirements is assessed based on the structural effort, which excludes temporary and one-off measures. Thus, Member States providing financial sector support are not forced to make additional fiscal consolidation efforts, provided that the necessary structural efforts are made. For example, in the context of the 2013 extension of the EDP deadline for Slovenia, the Council recommendation also referred to deficit targets, netting out the expected fiscal costs of financial sector support. Moreover, if a country is not able to correct its excessive deficit by the agreed deadline as a result of financial sector support, the procedure will not be stepped up. Instead, the abrogation of the procedure would be delayed for some time (usually one year).

However, when deciding on the abrogation of an EDP, the decision is based on the nominal (headline) deficit, which is not adjusted for financial sector support.

![]()

4 Fiscal risks related to government interventions in financial institutions

In addition to the above-mentioned fiscal costs, financial sector support can entail significant broader fiscal risks. If one were to include the amount of explicit contingent liabilities related to government guarantees granted to financial institutions, which have no immediate direct impact on government finances but pose a potential fiscal risk should they be called, the government’s exposure would be much higher.11 Moreover, governments also provided implicit guarantees to financial institutions, partly motivated by the too-big-to-fail argument and in order to avoid spillover effects. However, these implicit guarantees are difficult to quantify and are therefore not discussed further in this article.

At the outbreak of the financial crisis, many euro area governments provided explicit guarantees to financial institutions to support financial stability. Most explicit government guarantees were granted to ailing financial institutions for different kinds of liabilities and assets, such as issued bonds, interbank deposits, senior unsecured debt, asset-backed securities and dated subordinated debt. Furthermore, in a few cases, for example in Ireland, Spain and France, government guarantees were also granted for the financing of asset management vehicles (on average these amounted to about 20% of outstanding government guarantees at the

Chart 4

Financial exposure of governments arising from interventions in financial institutions

Source: ESCB.

Notes: The fi nancial exposure of governments arising from interventions in fi nancial institutions comprises the fi nancial assistance measures recorded under direct net fi scal costs and the amount of outstanding government guarantees. Government guarantees and net fi scal costs are expressed as a percentage of annual GDP.

Government guarantees do not include deposit insurance schemes.

end of 2014). Explicit guarantees were mainly granted in the early years of the crisis. The level of government guarantees granted, expressed in terms of GDP, exceeded the net fiscal costs of financial sector support until 2012 (see Chart 4). Government guarantees in the euro area peaked at almost 8% of GDP in 2009 (excluding government guarantees on retail deposits) and declined to 2.7% of GDP by the end of 2014.

Since 2012 the amount of outstanding government guarantees has declined strongly. This can be explained by three factors. First, a large share of guarantees has expired since then and, because financial stability has been re-established, it was not necessary to prolong them. There were no or only limited new guarantees granted to financial institutions in 2014. Second, in a few cases guarantees were called and the amounts were then recorded as general government debt. Third, some financial entities to which governments granted guarantees were recently reclassified inside the general government. This implied that the liabilities of the reclassified entities became part

11

The immediate direct impact of state guarantees on government finances relates to the collection of fees that financial institutions usually have to pay in exchange for the state guarantee, which results in government revenues. However, the collected fees have been rather limited for most countries. For the euro area, they amounted to an annual average of less than 0.05% of GDP during 2008-14.

of general government debt, while the amount of government guarantees to these entities declined accordingly.

While most euro area countries provided explicit government guarantees, their outstanding amount varied across countries. By far the highest level of government guarantees in terms of GDP was observed in Ireland, which peaked at 190% of GDP in 2008, but substantially declined thereafter to around 13% of GDP by the end of 2014 (see Table 3). Government guarantees at end-2014 were still sizeable in Greece and to a lower degree in Belgium, while they had been almost fully phased out in the Netherlands and Austria. For the latter, the decrease in guarantees is explained by the fact that one financial institution is now classified inside the general government, which implies that the respective government guarantees are no longer recorded, whereas gross government debt has increased by the amount of the outstanding liabilities of this entity.

Table 3

Outstanding government guarantees

Peak amount End of 2014

|

Percentage of GDP |

Year |

|||

|

BE |

15.4 |

(2009) |

9.3 |

|

|

DE |

5.5 |

(2009) |

0.8 |

|

|

IE |

190.0 |

(2008) |

12.9 |

|

|

GR |

37.9 |

(2011) |

28.5 |

|

|

ES |

9.9 |

(2012) |

5.2 |

|

|

FR |

4.7 |

(2009) |

2.2 |

|

|

IT |

5.3 |

(2012) |

1.4 |

|

|

CY |

16.9 |

(2010) |

5.7 |

|

|

LV |

2.8 |

(2009) |

0.2 |

|

|

LU |

4.8 |

(2013) |

4.6 |

|

|

NL |

12.1 |

(2009) |

0.0 |

|

|

5.0 |

(2009) |

0.0 |

||

|

PT |

9.5 |

(2012) |

3.6 |

|

|

Sl |

5.9 |

(2010) |

0.3 |

|

|

EA |

7.6 |

(2009) |

2.7 |

|

Sources: ESCB and Eurostat.

Notes: Estonia, Lithuania, Malta, Slovakia and Finland are not included in the table as they did not provide government guarantees to fi nancial institutions. The outstanding government guarantees do not include the guarantees on retail deposits and state guarantees for emergency liquidity assistance. The latter do not fall within the scope of the statistics on government guarantees

Several countries have experienced losses on government guarantees that were called. While for the euro area as a whole, the share of called guarantees seems to be rather limited, amounting to roughly 0.3% of total outstanding guarantees (less than 0.01% of GDP) in 2014, this figure might be somewhat misleading. In particular in cases of major restructuring of financial institutions, to which government guarantees were granted, the outstanding government guarantees decreased through the purchase of impaired assets previously guaranteed. In this respect, estimates of default probabilities can help form a view of the risk of government guarantees being called.[11]

In addition, many countries lifted the coverage threshold of their deposit insurance schemes. At the beginning of the crisis, the coverage of the national schemes was increased to a minimum level of €50,000 per depositor per bank. This threshold was then further raised to €100,000 as part of the revisions to the EU Directive on deposit guarantee schemes, which also led to the banks – rather than governments – having to cover the insurance. In contrast to the explicit guarantees provided for financial institutions’ assets, the deposit guarantee schemes are not time-restricted. Thus, they do not phase out unless it is decided to lower the threshold covered by the insurance. If claims were to be made, they would in the first instance be covered by the insurance, so the impact on budget balances would likely be limited.

Moreover, government guarantees might imply higher fiscal costs in the long run as they could, like other financial sector interventions, create adverse incentives for financial institutions. In fact, those institutions benefiting from government guarantees and other interventions might be inclined to take more risks or postpone a speedy repair of their balance sheets (see IMF, 2015, op. cit.). Moreover, government guarantees might not be fully credible, in particular if they are sizeable while the country’s fiscal space is limited, in which case governments would be unable to pay if the guarantees were to be called.[12] Credibility concerns, however, would make the resolution potentially more costly, as they would increase the likelihood of guarantees being called and the need for further measures in support of the financial sector. Thus, although government guarantees have almost no immediate direct impact on government finances, they might in the end result in higher direct fiscal costs.

Fiscal risks also relate to the newly created asset management vehicles for which fiscal costs could turn out higher than expected. More than half of the euro area countries created such vehicles in order to relieve the balance sheets of financial institutions by transferring impaired assets to these new entities at a reduced book value. Generally, asset management vehicles can be seen as an effective means for dealing with non-performing loans.[13] However, the potential fiscal risks related to asset management vehicles vary considerably across countries, depending on their specific characteristics in terms of government ownership, governments’ responsibilities in case of losses and the underlying financing strategy of the entities.[14] In particular when asset management vehicles are classified within the general government sector, all their liabilities are part of general government debt, as for example in the case of the BAMC in Slovenia (see Table 4). The future impact on the budgetary balance depends on how future revenues and expenditures evolve. If, however, the asset management vehicles are classified within the financial Table 4

Key features of selected asset management vehicles

![]()

|

Year of creation |

Government share |

Financing |

Assets1) percentage of GDP |

Haircuts on transferred assets2) per cent |

Net loss (-)/ profit (+) in 2014 percentage of GDP |

||

|

o/w bank loans |

|||||||

NAMA (Ireland) 2009 49% 7.3 8.4 7.2 57 0.2

SAREB (Spain) 2012 45% 4.3 4.8 3.1 46/63 -0.1 BAMC (Slovenia) 2013 100% 4.2 4.7 3.8 71 0.1

![]()

Sources: Websites of the asset management vehicles, and Gandrud and Hallerberg (2014, op.cit.).

1) Data refer to outstanding amounts as at the end of 2014.

2) Average haircuts applied by selected asset management vehicles (see Gandrud and Hallerberg, 2014, op.cit.). As regards Ireland, the haircut relates to loans worth €74 billion in total transferred to NAMA by the fi ve participating institutions (on payment of €31.8 billion as consideration) by the end of 2011. For Spain, the average haircut for the assets transferred was 46% in the case of loans and 63% in the case of foreclosed assets. For Slovenia, the fi gure given relates to assets transferred in 2013.

sector, the direct fiscal impact is likely to be more limited and mainly related to the risk that future dividends will not cover future losses, in which case the outstanding government guarantees would need to be called. In addition, ownership may be shared, as is the case with the asset management vehicles of Ireland (NAMA) and Spain (SAREB). Moreover, as demonstrated by NAMA and BAMC in 2014, asset management vehicles can also generate profits.

5 Conclusions

During the financial crisis, most euro area governments provided financial assistance to financial institutions with the aim of safeguarding financial stability and preventing a credit crunch. Accumulated gross financial sector assistance measures amounted to 8% of euro area GDP, of which only 3.3% has been recovered. The fiscal costs of the financial assistance measures over the period 2008-14 caused the euro area budget balance and debt to worsen by a cumulated 1.8% and 4.8% of GDP respectively. For the euro area as a whole, the financial sector support explains only a small part of the sharp increase in general government debt since the start of the crisis, while for some individual countries the impact on government debt has been substantial. Euro area countries used a variety of support measures, including bank recapitalisations, the provision of government loans, the acquisition of impaired assets, bank nationalisations and the granting of government guarantees. These measures impact recorded government debt and deficits to different extents. The size of these assistance measures is very heterogeneous across euro area countries. The interventions’ overall recovery rate is on average relatively low by international comparison. However, the recovery process is still ongoing. To complete the picture, it is also important to take the fiscal risks related to financial sector support into account, which mainly include the remaining government guarantees granted (amounting to 2.7% of euro area GDP at the end of 2014) and the potential losses (or possible holding gains) of asset management vehicles.

Looking ahead, it is important to secure financial stability while limiting taxpayers’ involvement. This requires in the first instance reducing the likelihood that financial institutions will face severe balance sheet problems. Much has already been achieved in tightening banking legislation, strengthening banking supervision, and should financial institutions indeed face problems, having the appropriate resolution instruments at hand. One important way to reduce the potential fiscal costs of financial assistance measures is to ensure an appropriate contribution by private shareholders and bondholders. Indeed, the EU Capital Requirements Regulation and Capital Requirements Directive IV and the newly created Single Supervisory Mechanism will enhance the resilience of the banking sector and should help prevent the build-up of severe problems on banks’ balance sheets which could ultimately result in a severe banking crisis. In addition, the EU Bank Recovery and Resolution Directive and the Single Resolution Mechanism will ensure private sector involvement ahead of government assistance. Taken together, these key pillars of the European banking union should ensure that the risk of additional taxpayer support gradually diminishes.

[1] See for example “The impact of government support to the banking sector on euro area public finances”, Monthly Bulletin, ECB, July 2009; van Riet, A. (ed.), “Euro area fiscal policies and the crisis”, Occasional Paper Series, No 109, ECB, 2010; and Stolz, S. and Wedow, M., “Extraordinary measures in extraordinary times: public measures in support of the financial sector in the EU and the United States”, Occasional Paper Series, No 117, ECB, 2010.

[2] The analysis is based on data compiled by the Working Group on Government Finance Statistics of the European System of Central Banks (ESCB).The statistical framework is described in more detail in Maurer, H. and Grussenmeyer, P., “Financial assistance measures in the euro area from 2008 to 2013: statistical framework and fiscal impact”, Statistics Working Paper Series, No 7, ECB, 2015.

[3] In the literature, there are two main approaches to estimating the fiscal costs of financial sector support (see also ECB, 2009, op. cit.). First, the bottom-up approach sums up all of the government interventions; see for example Laeven, L. and Valencia, F., “Systemic banking crises database: an update”, Working Paper Series, No 163, IMF, 2012. Second, the top-down approach assumes that changes in the government debt-to-GDP ratio since the crisis are related to the financial crisis, although this approach also includes debt changes which are unrelated to financial sector support.

This approach is followed inter alia by Reinhart, C. and Rogoff, K., “Recovery from Financial Crises: Evidence from 100 Episodes”, American Economic Review, Vol. 104(5), 2014, pp. 50-55.

[4] Central bank liquidity measures are discussed, for example, in “The ECB’s non-standard measures – impact and phasing-out”, Monthly Bulletin, ECB, July 2011; “The ECB’s response to the financial crisis”, Monthly Bulletin, ECB, October 2010; and “The implementation of monetary policy since August 2007”, Monthly Bulletin, ECB, July 2009.

[5] While the difference is usually very small, there are some exceptions. For example, in Ireland, some financial assistance measures have been financed through the disposal of assets held by government pension funds.

[6] See “From Banking to Sovereign Stress – Implications for Public Debt”, IMF, 2015, which analyses how certain country and banking sector characteristics impact the fiscal costs of banking crises.

[7] To get an idea of governments’ financial exposure arising from financial sector support, the net fiscal costs have to be supplemented by the amount of outstanding government guarantees and include the indirect revenues. In the literature, however, it is sometimes argued that gross fiscal costs (which encompass recovered assets) are a better metric to reflect the taxpayers’ money spent at the time of the support. This indicator could also serve as a basis for determining the financial buffers needed for government assistance in the context of possible future crises (see for example Laeven, L. and Valencia, F., op.cit.).

[9] With regard to Greece, the substantial difference between gross and net fiscal costs is mainly explained by the following facts. Until 2012 the Hellenic Financial Stability Fund provided loans to the Greek banking system. These loans were subsequently used to bridge the time until recapitalisations in the form of equity acquisitions could take place (2013). Although this basically represents a shift in instruments, the gross fiscal costs include both loans and recapitalisations, while the net fiscal costs are adjusted for the loans cancelled after recapitalisations.

[10] See the box entitled “The fiscal implications of financial sector support”, Monthly Bulletin, ECB, June 2013.

[11] See “Fiscal implications of the global economic and financial crisis”, Occasional Paper Series, No 269, IMF, 2009. Based on the estimation of the expected default frequency-implied credit default swap spreads, using November 2008 market data, outlays from state guarantees were estimated to be in the order of 1-3% of GDP in cumulative terms for 2009-13 for advanced economies.

[12] Partly as a result of substantial government guarantees, rating agencies have downgraded a number of euro area countries, which led to an increase in their financing costs (see Stolz and Wedow, 2010, op. cit.).

[13] See “Resolving the legacy of non-performing exposures in euro area banks”, Financial Stability Review, ECB, May 2015.

[14] Privately owned asset management vehicles usually impose larger haircuts on the acquired assets than publicly owned entities, which affects the profitability of the entities and the subsequent fiscal risks. The haircut applied to transferred assets has varied from 0% to more than 50%. See Gandrud, C. and Hallerberg, M., “Bad banks in the EU: the impact of Eurostat rules”, Working Paper Series, No 15, Bruegel, 2014.

Poslední zprávy z rubriky Dluhopisy:

Přečtěte si také:

Prezentace

26.04.2024 Historie a vývoj vodovodních baterií: Od...

25.04.2024 Pobřeží Egejského moře - ideální tip na všechny...

24.04.2024 Výsledková sezóna: Jak se daří výrobcům čipů a...

Okénko investora

Olívia Lacenová, Wonderinterest Trading Ltd.

Dlouho očekávaná událost ze světa kryptoměn. Přinese další halving bitcoinu nová maxima?

Štěpán Křeček, BHS

Petr Lajsek, Purple Trading

Ali Daylami, BITmarkets

Michal Brothánek, AVANT IS

Miroslav Novák, AKCENTA

Spotřebitelská inflace v eurozóně odeznívá, pro služby to však úplně neplatí

Jiří Cimpel, Cimpel & Partneři

Jakub Petruška, Zlaťáky.cz