ECB publishes consolidated banking data for end-March 2023

3 August 2023

- The aggregate of total assets of EU-headquartered credit institutions declined from €31.71 trillion in March 2022 to €31.34 trillion in March 2023, a decrease of 1.17%

- During the same period, EU credit institutions’ aggregate non-performing loans ratio[1] declined by 0.13 percentage points year on year to stand at 1.83% in March 2023

- EU credit institutions’ aggregate return on equity[2] was 2.53% in March 2023 and their Common Equity Tier 1 ratio[3] was 15.58%

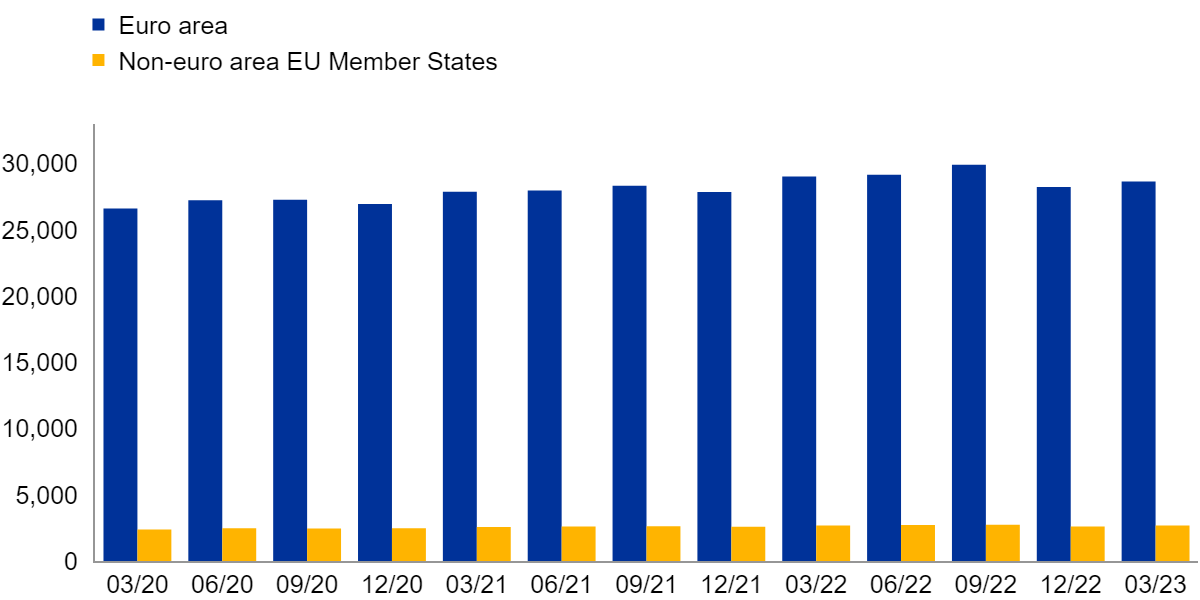

Chart 1

Total assets of credit institutions headquartered in the EU

(EUR billions)

Source: ECB

Note: Data for all reference periods relate to the EU27. As of 2023 Croatia is included in the Euro area countries. The total assets for end-March 2023 for Croatia amounted to 8.6 EUR billions.

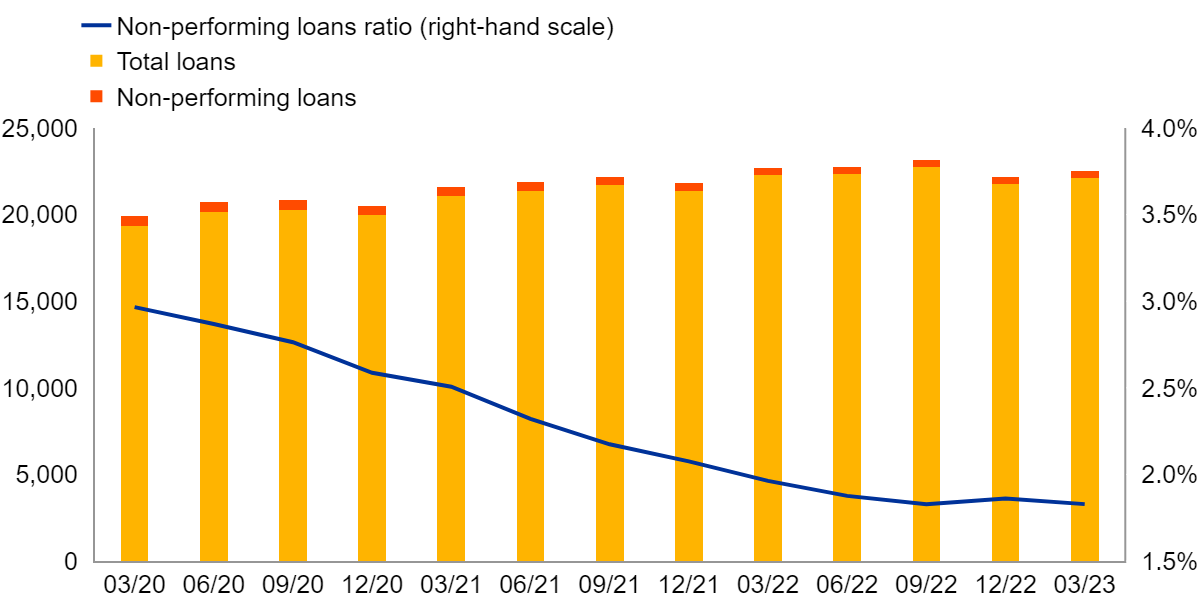

Chart 2

Non-performing loans ratio of credit institutions headquartered in the EU

(EUR billions; percentages)

Source: ECB

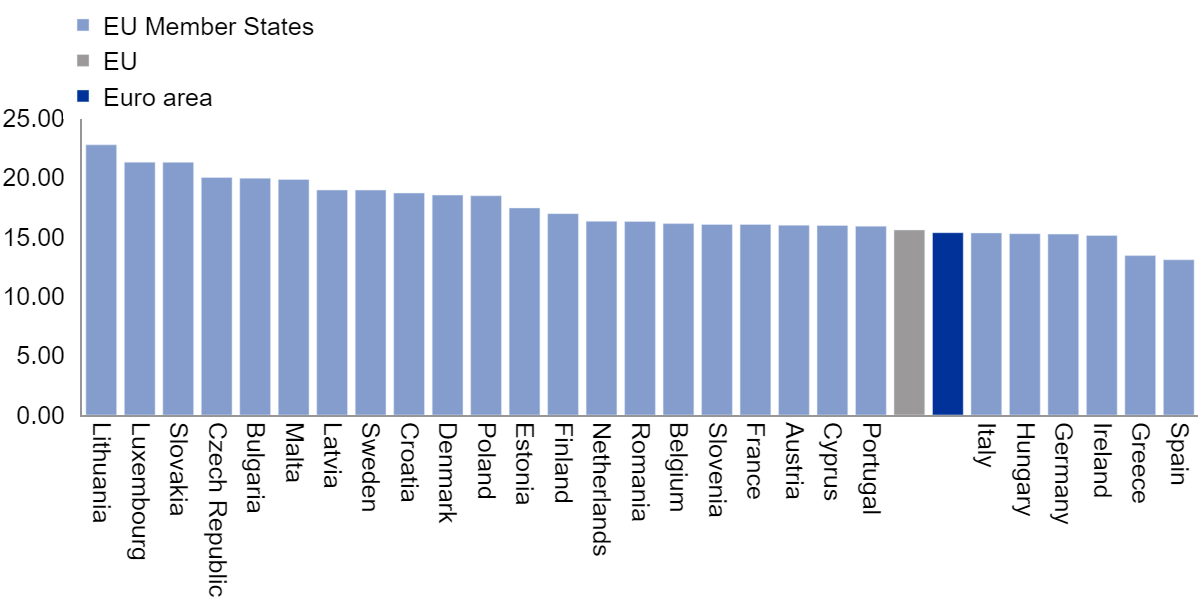

Chart 3

Return on equity of credit institutions headquartered in the EU in March 2023

(percentages)

Source: ECB

Note: As of 2023 Croatia is included in the Euro area countries.

Chart 4

Common Equity Tier 1 ratio of credit institutions headquartered in the EU in March 2023

(percentages)

Source: ECB

Note: As of 2023 Croatia is included in the Euro area countries.

The European Central Bank (ECB) has published consolidated banking data as at end-March 2023, a dataset for the EU banking system compiled on a group consolidated basis.

The quarterly data provide information required to analyse the EU banking sector and comprise a subset of the information that is available in the year-end dataset. The data cover 316 banking groups and 2369 stand-alone credit institutions operating in the EU (including foreign subsidiaries and branches), accounting for nearly 100% of the EU banking sector’s balance sheet. They include an extensive range of indicators on profitability and efficiency, balance sheet composition, liquidity and funding, asset quality, asset encumbrance, capital adequacy and solvency. Aggregates and indicators are published for the full sample.

Reporters generally apply International Financial Reporting Standards and the European Banking Authority’s Implementing Technical Standards on Supervisory Reporting. However, some small and medium-sized reporters may apply national accounting standards. Accordingly, aggregates and indicators may include some data that are based on national accounting standards, depending on the availability of the underlying items.

In addition to data as at end-March 2023, the published figures also include a few revisions to past data.

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- These consolidated banking data are available in the ECB Data Portal.

- More information about the methodology used to compile the data is available on the ECB's website.

- Hyperlinks in the main body of the press release lead to data that may change with subsequent releases as a result of revisions.

Related topics

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts