ECB publishes consolidated banking data for end-December 2022

22 June 2023

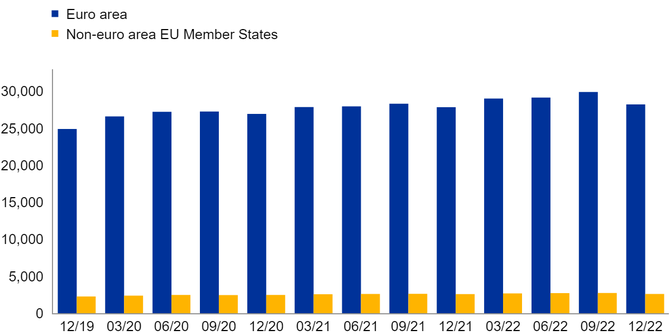

- The aggregate of total assets of EU-headquartered credit institutions rose from €30.44 trillion in December 2021 to €30.85 trillion in December 2022, an increase of 1.34%

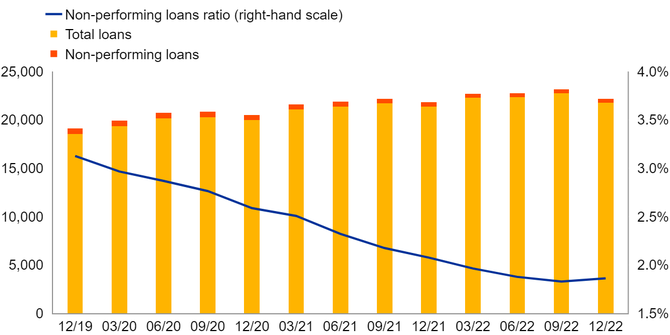

- EU credit institutions’ aggregate non-performing loans ratio[1] declined by 0.21 percentage points year on year to stand at 1.86% in December 2022

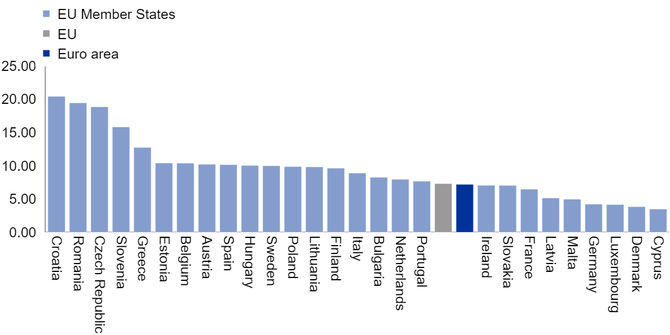

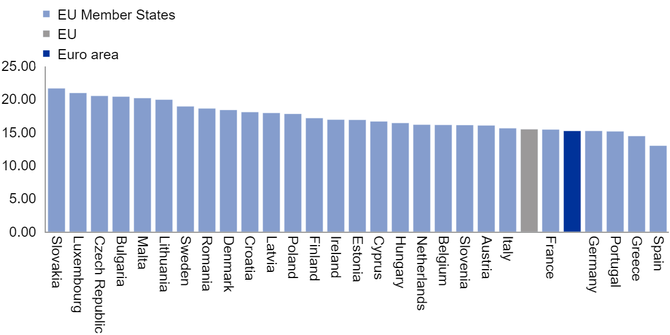

- EU credit institutions’ aggregate return on equity[2] was 7.3% in December 2022 and their Common Equity Tier 1 ratio[3] was 15.45%

- Euro area banks and banking groups recorded an aggregate net stable funding ratio of 125.06% at the end of 2022, with banks in all member countries averaging well above the required minimum threshold of 100%

Chart 2

Non-performing loans ratio of credit institutions headquartered in the EU27

(EUR billions; percentages)

Source: ECB

Chart 3

Return on equity of credit institutions headquartered in the EU in December 2022

(percentages)

Source: ECB

Chart 4

Common Equity Tier 1 ratio of credit institutions headquartered in the EU in December 2022

(percentages)

Source: ECB

The European Central Bank (ECB) has published consolidated banking data as at end-2022, a dataset for the EU banking system compiled on a group consolidated basis.

These annual data provide information required to analyse the EU banking sector and are broader in scope than the standard quarterly releases. The data cover 314 banking groups and 2,375 stand-alone credit institutions operating in the EU (including foreign subsidiaries and branches), accounting for nearly 100% of the EU banking sector’s balance sheet. They include an extensive range of indicators on profitability and efficiency, balance sheet composition, liquidity and funding, asset quality, asset encumbrance, capital adequacy and solvency. Aggregates and indicators are published for the full sample.

Reporters generally apply the International Financial Reporting Standards and the European Banking Authority’s Implementing Technical Standards on Supervisory Reporting. However, some small and medium-sized reporters may apply national accounting standards. Accordingly, aggregates and indicators may include some data that are based on national accounting standards, depending on the availability of the underlying items.

As a consequence of the global financial crisis, the Basel Committee on Banking Supervision strengthened its framework, establishing, among other things, a minimum requirement for funding: the net stable funding ratio. This was implemented via the revised version of the Capital Requirements Regulation that was published in June 2019 and became applicable on 28 June 2021 with the aim of preventing excessive maturity mismatches between assets and liabilities and over-reliance on short-term wholesale funding.

In addition to data as at end-December 2022, the published figures also include a few revisions to past data.

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- These consolidated banking data are available in the ECB’s Statistical Data Warehouse.

- More information about the methodology used to compile the data is available on the ECB's website.

- Hyperlinks in the main body of the press release lead to data that may change in subsequent releases as a result of revisions.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts